At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen.

As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household, moving onto the home as the hub for health care and self-care enabled by digital tools and tech, and finish up with an outlook on health politics in America for 2024 — a very uncertain picture with lots of uncertainties and a couple of wild cards to consider.

The U.S. Consumer in the Big/Macro U.S. Economy

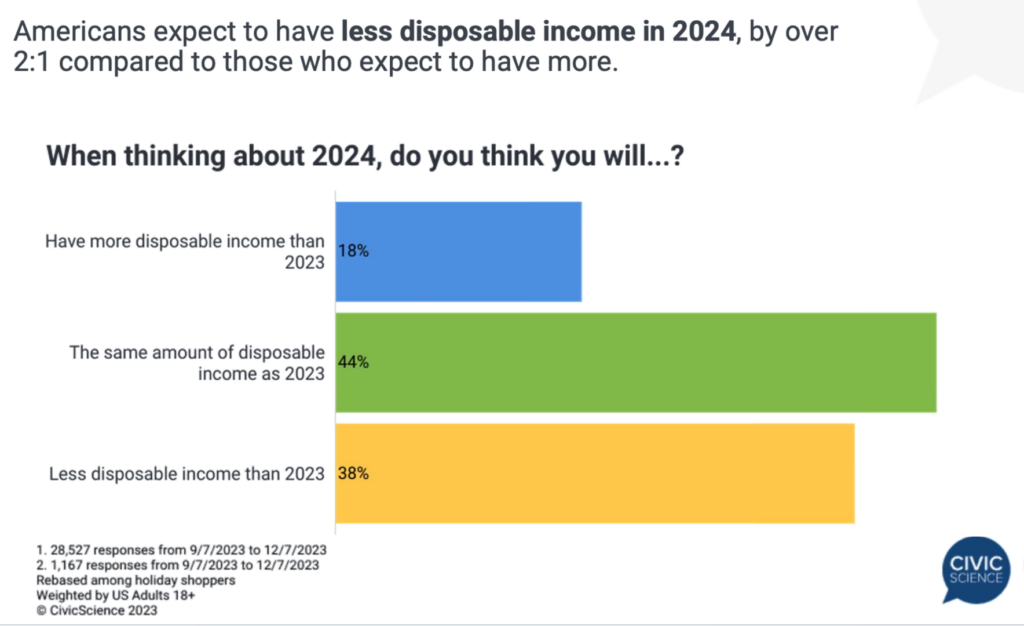

Inflation, a top-of-mind stress and concern for mainstream Americans in 2023, is easing as we enter 2024. U.S. households recently had positive news from the Federal Reserve Bank as Chairman Jerome Powell discussed interest rates unchanged and three rate cuts expected in 2024, giving some assurance that “the finish line is in sight” in terms of a so-called soft-landing for the U.S. economy. Another positive aspect of the U.S. macroeconomic story is that Federal Chair Powell also noted that inflation in the U.S. continues to come down alongside a more balanced job market.

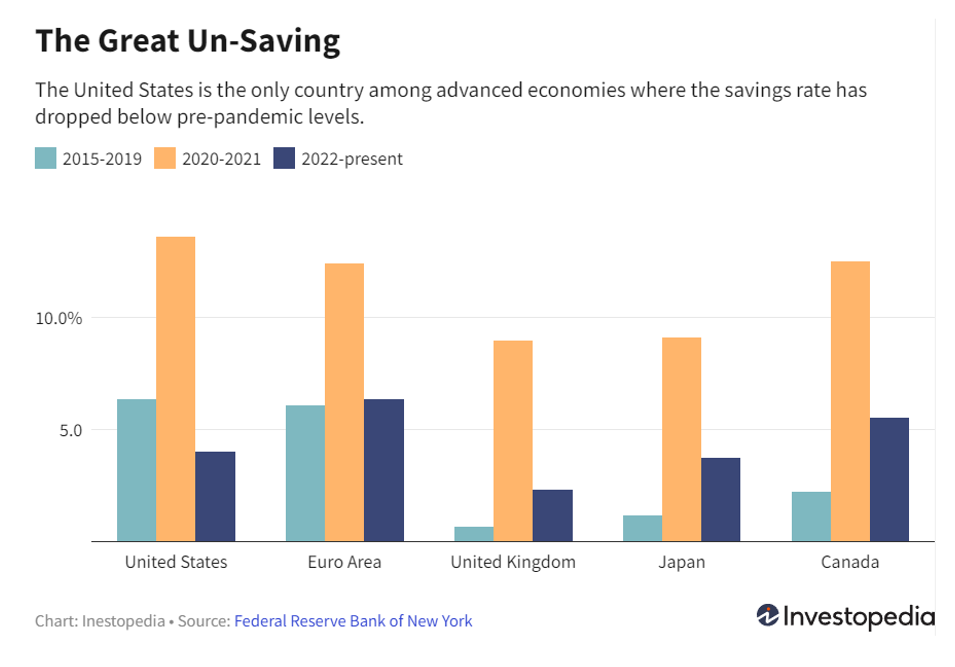

On the downside of the consumer household economy, savings are down in the post-pandemic period – coined a period of “Great Un-Saving.”

In what the Federal Reserve Bank of New York sees as an “only-in-the-U.S.” phenomenon,

Americans differ from peers in other developed nations from Canada, Japan, and Western Europe who are saving more of their disposable income than pre-pandemic rates. In contrast, residents of the U.S. appear to have a “YOLO” attitude about spending – that is, in the profligate spending style of “You Only Live Once.”

As a recent team of BBC journalists wrote looking across the Atlantic, this YOLO spending style has bolstered Americans’ spending using Buy Now, Pay Later (BNPL) programs, boosting credit card debt upwards that will come due in early 2024. Paying down such debt can also serve to crowd out other household spending – on the things of daily living as well as health care costs.

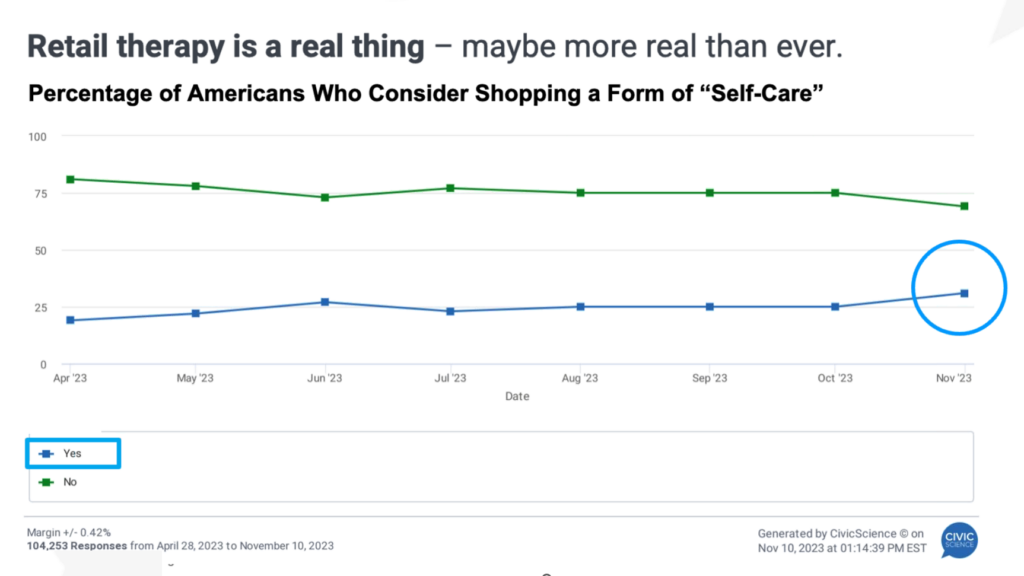

Ironically, CivicScience recently called out a cadre of U.S. retail consumers whose retail shopping activities took on a role of “self-care” to improve mood in the immediacy of the purchases (giving the concept of “Buy Not Pay Later” another meaning for the immediate gratification of so-called “retail therapy”). This attribute covers about 1 in 4 U.S. adults, CivicScience found.

The U.S. health care micro-economy and how health costs will continue to crowd out other household spending in 2024

Consumers’ financial health blurs (or sometimes bleeds) into their personae as patients: CivicScience has tracked a direct relationship between peoples’ perceptions of financial health and one’s overall well-being.

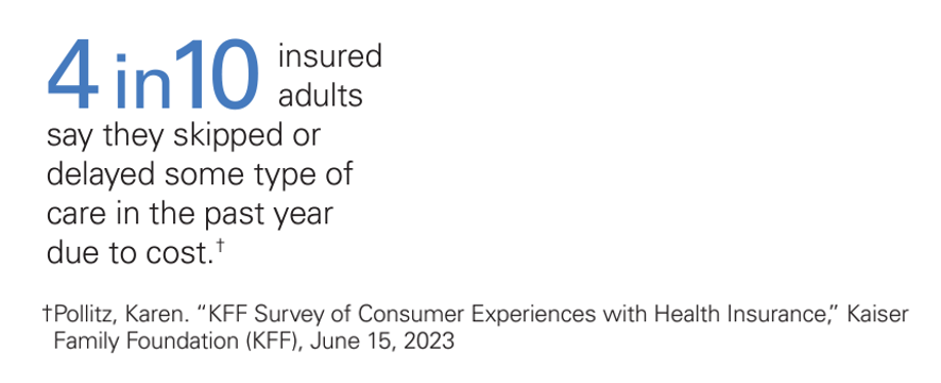

There’s a sort of health care “shrinkflation” that has been shaping patients-as-payors of medical bills. Dr. Robert Pearl has recently written about this in terms of re-sizing health care the way packaged goods companies can downsize the toothpaste tube or cereal box you source at the grocery store. In health care, consider the concept of “skinny” health plans and the pile-up of prior authorizations denied or delayed. On the consumer side, I’ve long addressed self-rationing and postponing or avoiding care due to cost, a major recurring theme in this Health Populi blog since its inception in 2007 – when I launched this site in the midst of The Great Recession and referred to the gas station pricing sign from Tom’s Shell noting the cost of cast felt like you were spending an arm or a leg on a gallon of petrol at the pump.

Even with inflation easing in the U.S. entering 2024, many consumers will be self-rationing care due to costs.

One of the five factors the Deloitte health care team identified that will reshape health care in 2024 is affordability and empowered consumers – as consumer health care expenses such as premiums and out-of- pocket costs are expected to increase in the new year, again in the context of growing consumer credit card debt, declining savings rates, and higher health care costs for employers and other payors.

Deloitte makes the point that, “Consumers are at the heart of the transition from consolidation and fragmentation to convergence” in their role in the U.S. health care ecosystem, making decisions for shoppable medical products and services based on price and convenience.

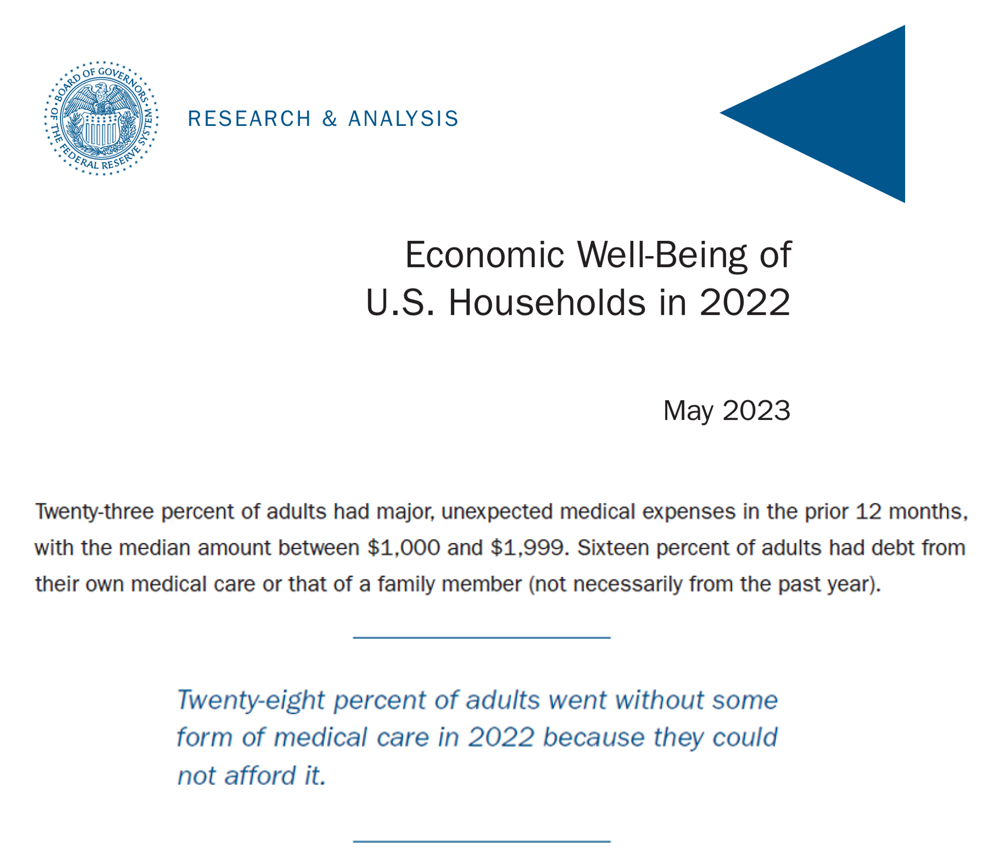

Further refining the point that patients’ medical bills and expenses are now part of their household and retail financial budgets, the Federal Reserve published this report on households’ well-being, asserting that 23% of U.S. adults had major, unexpected medical expenses in the past 12 months ranging from $1,000 to $1,999.

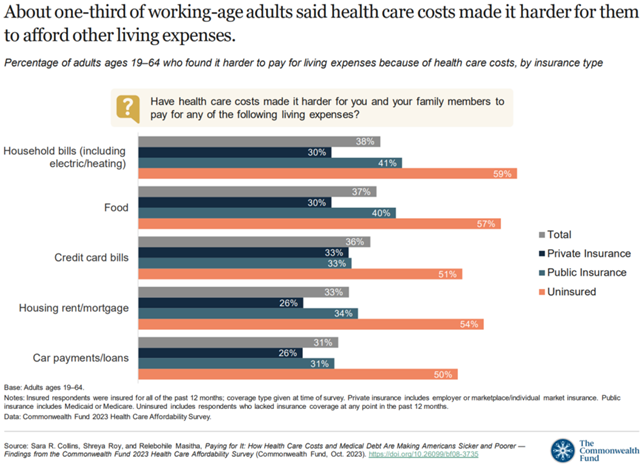

The issue of health care costs then crowding out other living expenses was quantified, by category, by The Commonwealth Fund in this report aptly titled, Paying for It: How Health Care Costs and Medical Debt Are Making Americans Sicker and Poorer.

One additional point to make here is that, as we’ve found in previous years, one-third of consumers in the U.S. are not confident that they could pay a medical bill of $500 or more, discussed in October 2023 in a study on patients and medical costs conducted by Access One.

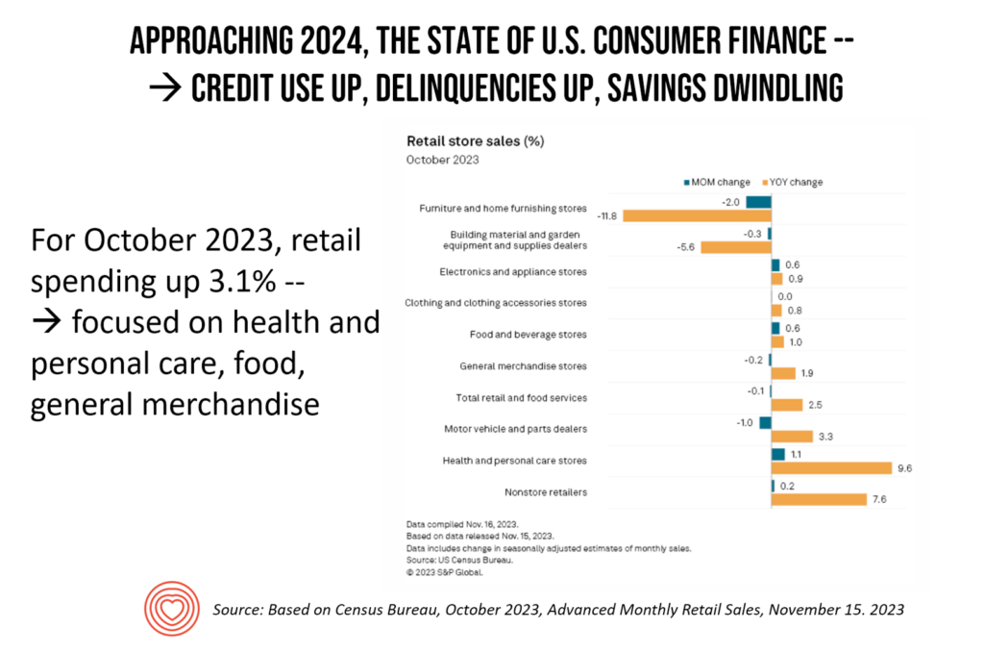

The Federal Reserve isn’t the only national fiscal expert on U.S. consumer spending: the Census Bureau also tracks Americans’ retail spending behavior. See the bar chart I titled “Approaching 2024…,” In the context of consumers increasing the use of credit and growing delinquencies in paying back debt, savings dwindling, you see that retail spending grew for several categories in latter 2023 – notably, health care followed by non-store retail sales (in Census-language, non-store retailers are sellers via infomercial and broadcast media, catalogue sales, and direct-to-consumer sales).

The stress of health care costs

Money – the lack thereof – and stress go hand-in-hand. But health care costs in and of themselves specifically create stress for patients-as-payors, as well – another uniquely American phenomenon.

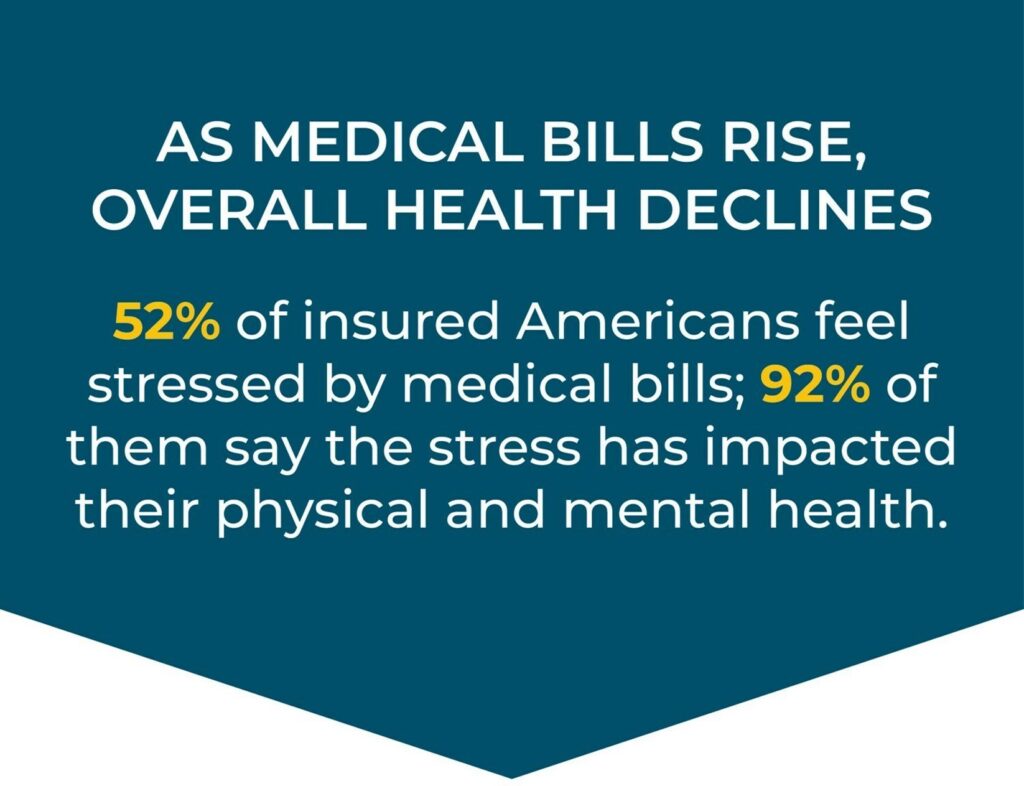

As medical bills rise, overall health declines we learned from the 2023 PayMedix report, Healthcare Payments and Financial Disparities Study. This is financial stress felt among patients who were covered by health insurance – and not the uninsured per se.

By mid-2023, employees’ financial wellness dropped to a new low, SHRM called out. Companies covering health insurance are responding: employed consumers covered by health insurance through the workplace will find more financial health support from employee health benefit plans in 2024. As multi-generational workforces compel HR departments to align workers’ interests and needs with benefit menus, the challenge of financial wellness confronts people across age cohorts in different ways: younger workers may be managing the burden of student loan re-payments or childcare access, whereas older workers looking into retirement might be choosing to postpone full-on retirement in order to save more cash post-pandemic to boost savings for aging and long-term care needs, EBRI found.

The growing normal of loneliness and embrace of tele-mental health

Mental health and medical bills will be inextricably linked for many people who will start the New Year with mashed up resolutions that bridge fiscal health with physical and behavioral health. Fidelity Investments recently explored this topic. Over one-half of U.S. adults feels overwhelmed by their personal finances, and 1 in 3 has a stressful relationship with money.

Financial health is one driver of stress, shame, and mental health impact. The U.S. Surgeon General’s report on loneliness and isolation was published in 2023, giving further impetus, empathy, and support to the issue facing individuals and communities across the U.S. In 2024, both public and private sector payors and providers will be bolstering the resources allocated to deal with peoples’ mental health: for example, Medicare will add news types of health providers to the supply side of clinicians supporting older Americans who have been cut off from access to the mental health workforce in terms of payment for therapy services. At the other end of the age spectrum, there is greater recognition entering 2024 that the epidemic of younger people facing un-served mental health conditions could “hobble” the U.S. economy.

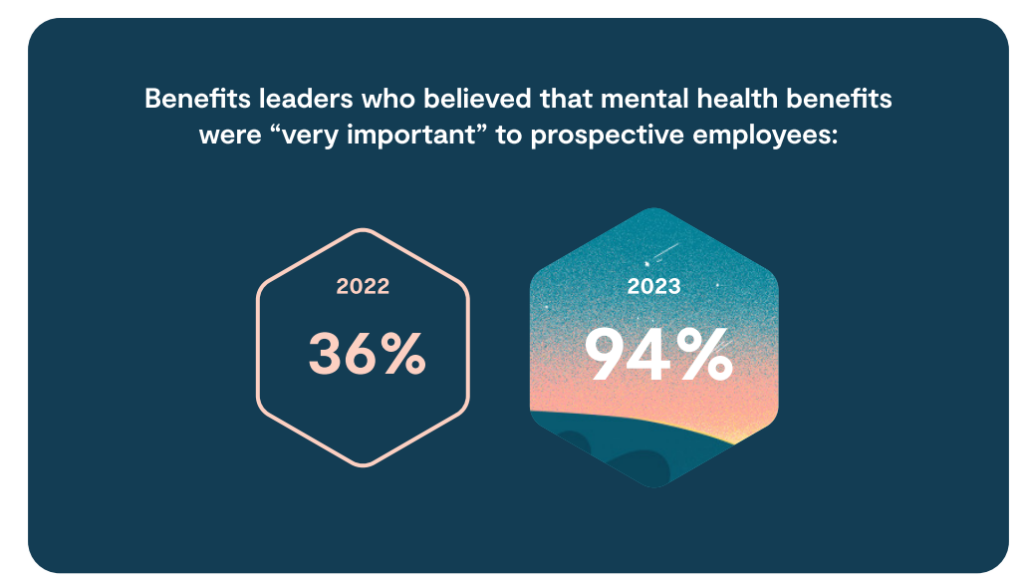

Among Lyra Health’s 2024 predictions for mental health, the company tracked a dramatic spike upward in the proportion of benefits leaders who believed mental health benefits were very important to employee prospects: that sentiment rose from 36% of HR benefit leaders in 2022 up to 94% in 2023, signaling the mainstreaming of accepting and , we infer, addressing mental health needs of the workforce and families in the new year.

2024 will be “the year of weight loss”

While weight loss resolutions have marked the beginning of every New Year since I started tracking such things, the start of 2024 feels somehow different for this trend.

Scott Galloway wrote on his No Mercy/No Malice website,

“I believe there is another innovation that will also be transformative as its full impact and second-order effects play out. What GPT is to the media, GLP-1 will be to the real economy.”

Professor Galloway pointed out in his 2024 predictions the sheer scale that this new drug category could have on over 100 million Americans alone. Millions of people are interested in losing weight – more likely women than men, but still one-third of men. A recent poll from Toluna found that 30% of people aware of prescription weight-loss drugs would want to use them.

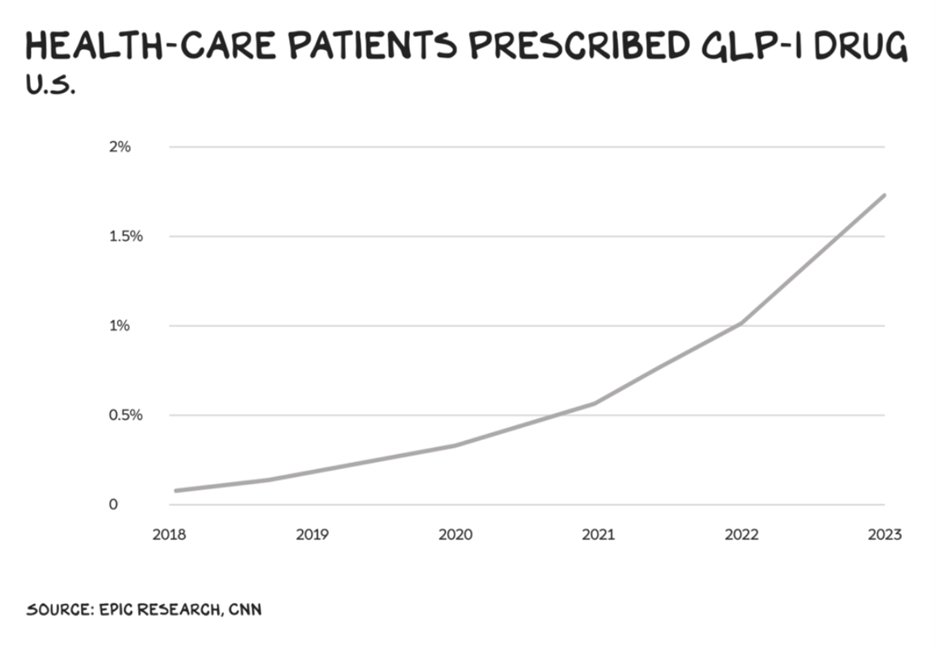

In this early phase of GLP-1 drug prescription, we’ve seen hockey-stick-like growth in consumer adoption of the medicines, skewing among higher-income people – with the immediate prospects of disparities in prescribing and access of a medicine that could profoundly impact public health (for example, diabetes hits lower-income populations harder whereas weight-loss programs attract younger, more affluent consumers).

As a result, some consumers may face delays in accessing GLP-1 drugs in 2024 as health insurance plans, keen to rationalize costs of this explosive new category of prescription drug spending, implement restrictions on just who should receive the product and be reimbursed for its use.

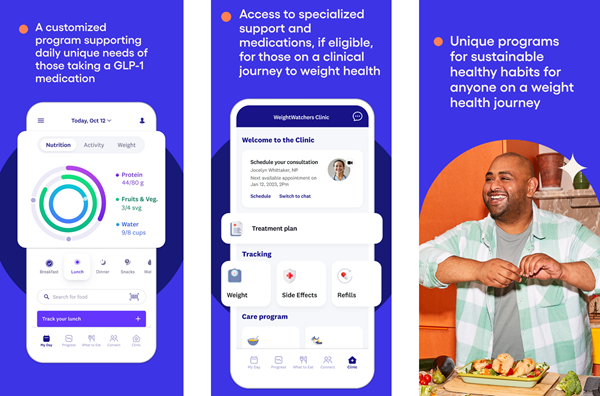

If 2024 is the Year of Weight Loss, it will also be the Year of Weight Loss Programs embedding the use of GLP-1 medicines in the business plans. Notably, Weight Watchers/W began to offer a new telehealth program for weight loss featuring the use of GLP-1 medications, its app shown here – which has been endorsed by W spokeswoman Oprah Winfrey, long-associated with weight loss endeavors — talking with People magazine about her own personal use of GLP-1 meds.

An evolving food-scape and grocery store profile in 2024

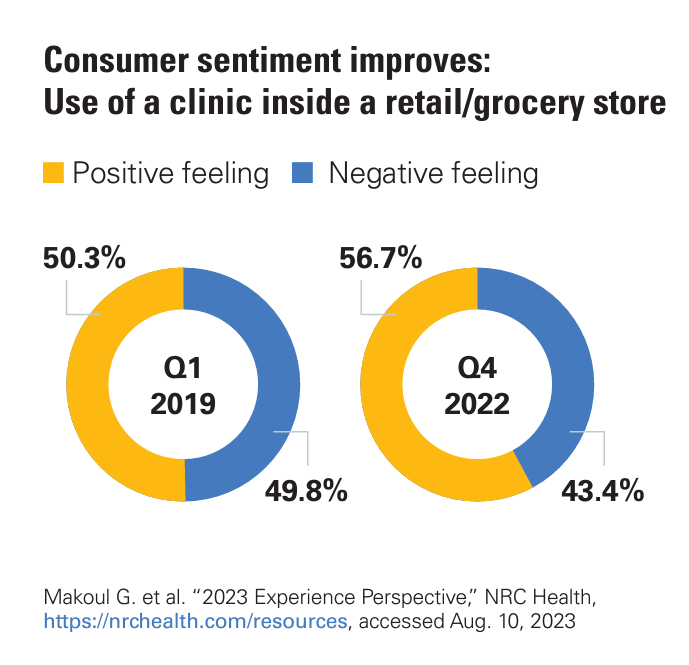

Consumers adopted grocery stores as health/care destinations in the COVID-19 pandemic, as grocers were essential retail sites for sourcing not only food but hygiene and home care products as well as the pharmacy inside the store. More consumers have positive feelings about using a health clinic inside of a retail or grocery store, part of the evolving consumer-facing fragmentation/consolidation noted earlier in this post. A growing cadre of patients-as-consumers and -payers are voting with their feet, health insurance, and out-of-pocket wallets for care closer to home and at-home.

Grocery stores with co-located pharmacies also provide health care services and, of course, vaccinations for those health citizens keen to protect themselves and loved ones from exposure to the coronavirus. In 2024, dietitians engaged through the pharmacy will continue to serve grocery store customers as a link between pharmacists and the core food business of grocery.

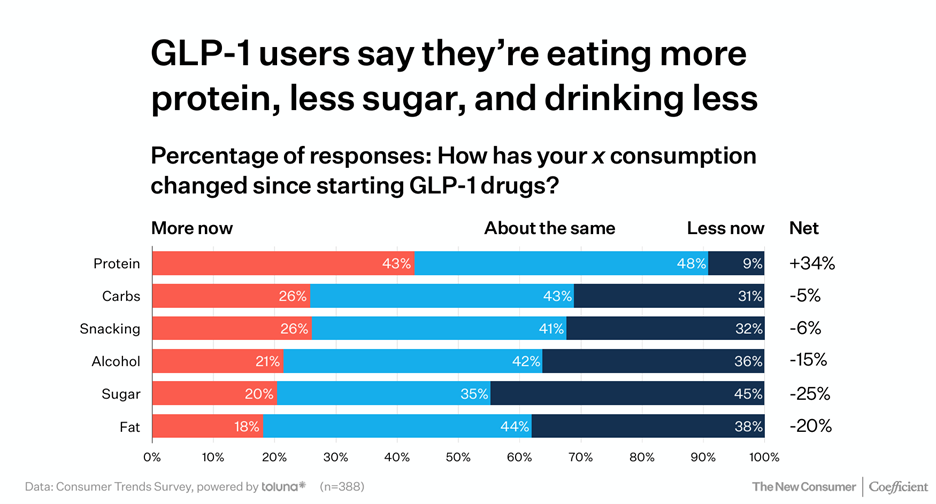

As we noted the mantra that 2024 might be the Year of Weight Loss, the drug category has already re-shaped the food industry in some notable ways: GLP-1 users told Toluna market researchers that as a result of taking the medicine, they were eating more protein, less sugar, and consuming less alcohol.

Leslie Sarasin, President and CEO of FMI-The Food Industry Association, talked about health and wellbeing in the grocery in her 2024 forecast, saying,

We’re spending a lot of time getting ready for and continuing to advance is our work in health and wellbeing. We know that the grocery store is and should be and can be a destination for health and wellbeing for our customers. Being able to work with our companies to make sure that the combination of food as medicine, medicine as medicine, using our pharmacies, using our registered dieticians, the plethora of availability of registered dieticians in our grocery stores is amazing and so to the extent our customers learn more about that option and the availability of that resource to them, I think we as an industry can continue to make a positive impact on the health and wellbeing of the nation.

That supply-side response will be embraced by consumers who have begun to view the grocery store as a partner in their and their families’ health and well-being and are allocating household spending to food-as-medicine and for health goals.

Consumers keen to bolster health through food-as-medicine purchases and new food items for various aspects of health have been shown to spend hard-earned dollars on these items – even if they may choose to avoid filling a prescribed medicine for a medical condition.

Key aspects of health for which consumers are seeking support from the grocery store aisles are resilience and energy, brain health, sleep and rest, and to be sure, weight loss.

Organic food, too, will continue to go even more mainstream in 2024, expected by The Packer survey on Organic Fresh Trends 2024.

In 2023, 2 in 3 U.S. consumers had purchased organic produce at least some of the time – one-half doing so for nutrient content and personal health, and another 44% for environmental and social responsibility.

It’s important to note that Americans are not just buying organic food from traditional “healthy” food stores; 25% are shopping organic at chain superstores like Walmart and Target and warehouse clubs like Costco, Sam’s Club, and BJ’s Warehouse Club. One in ten people are shopping at farmers’ markets for organics.

Consumers will also seek food-as-medicine support from grocery stores, with companies such as Kroger growing its Kroger Health identity recently announcing its entry into “value-based primary care in the Atlanta metro market. Complementing this effort, Kroger also launched a personalized health and nutrition program collaborating with Soda Health earlier in December – importantly, aimed at people enrolled in Medicaid and Medicare programs. We also expect the Kroger-Albertson’s merger, under FTC scrutiny in 2023, to likely be completed in 2024 which will further consolidate the two grocery chains’ role in consumers’ health-at-home.

The biggest uncertainty in 2024: health politics (think women’s health and prescription drug pricing)

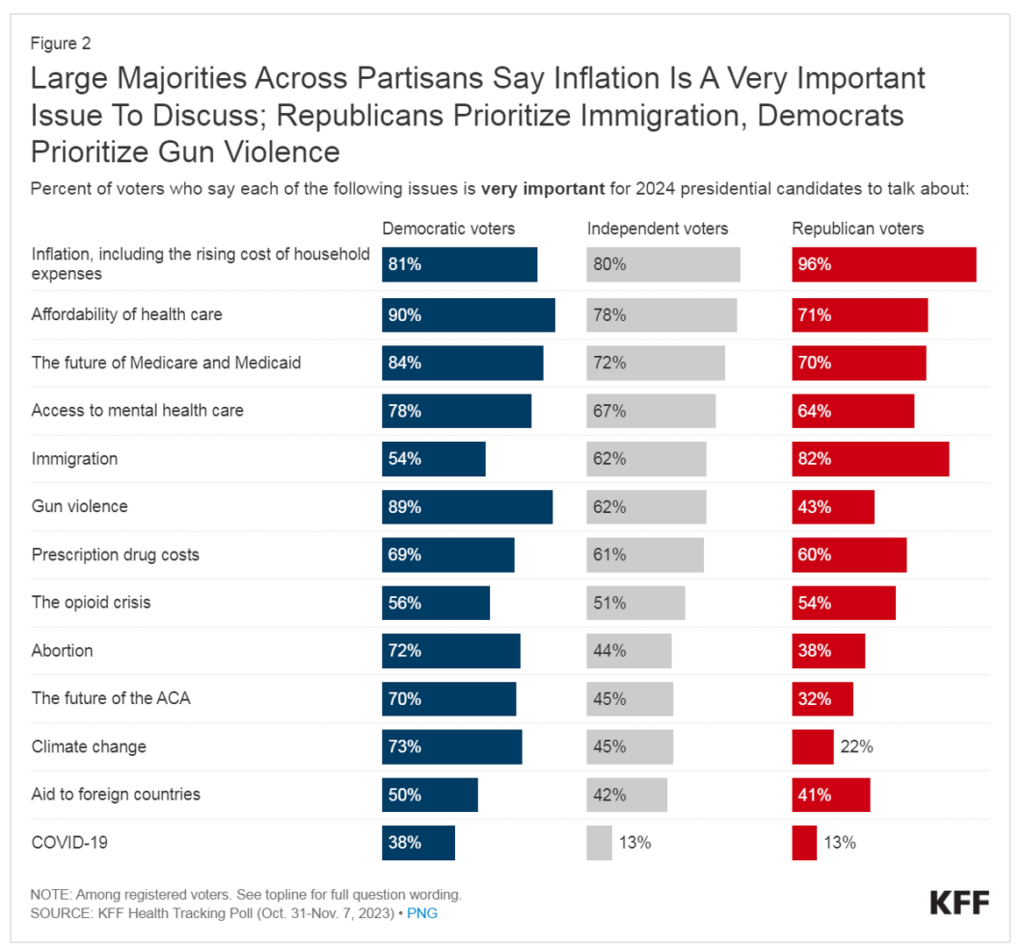

Inflation, the affordability of health care and prescription drug costs will rank high on U.S. voters’ minds in 2024, along with public health challenges of gun violence and the opioid crisis, the Kaiser Family Foundation quantified in the organization’s health tracking study published December 1.

On the prescription drug pricing prospects, health consumers are already benefiting from some private sector strategies most notably driven by Mark Cuban whose Cost Plus Drug Company has replicated a sort of Costco-inspired model for drug pricing which has begun to shake up the channel for medicines. We can expect more innovation from Cuban’s organization, expanding into specialty drugs and novel business models and patient populations.

That leaves women’s health care – measured in the KFF tracking poll under the survey question asking how important the issue of abortion was to voters identifying as Democrat, Independent, or Republican. Note that Abortion ranked very important among 72% of Democrats, 44% of Independents, and 38% of Republicans.

Women’s health care will continue to be a lightning-rod issue in 2024 throughout the year leading up to the November elections. The issue will be on the ballot explicit in at least 12 states, and implicitly in the national election for President driving some voters to the polls as a top-ranked motivation to engage in politics – in this case, women’s access to health care, broadly writ, and even broader, the perspective that some portion of U.S. citizens have lost access to a civil right.

As we enter 2024 as health consumers and health citizens, we can identify certainties as well as uncertainties. What we-know-we-know is that health care costs will rise, and patients-as-payors will be compelled to deal with greater out-of-pocket costs, lagging transparency for shoppable services, and an expanding array of services that might add to fragmentation of care if they are not integrated into a continuum through, at a minimum, an interoperable health record.

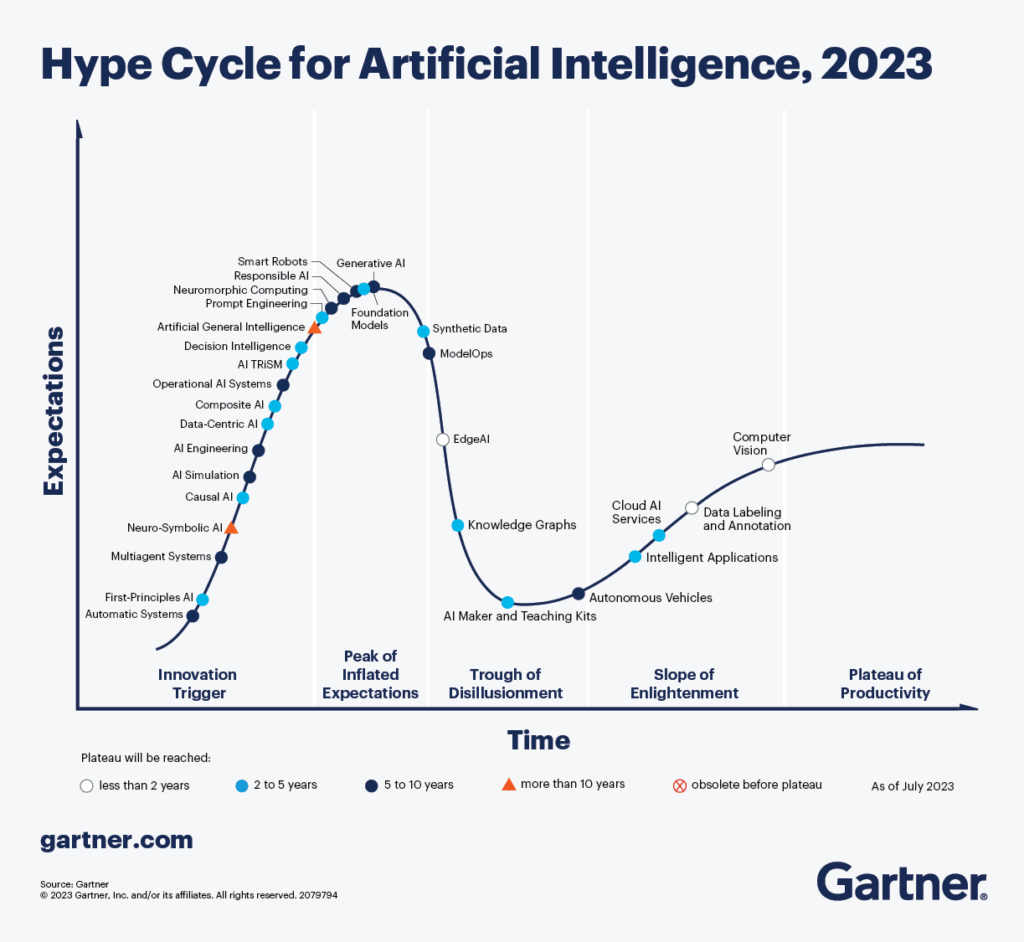

The growing role of AI and, more generally technology will also play out across the health/care ecosystem in 2024, with GenAI’s apex at the peak of inflated expectations in the Gartner Hype Cycle moving south and to the right into more pragmatic territory. As AI gets embedded into consumers’ health care, patients will come to trust the technology and its capabilities more….with the potential of a wild card adverse event connected with a badly-informed clinical decision threatening that trust. In 2024 we’ll continue to see a sort of “concerned embrace” of AI among consumers engaged in health, based on Wolters Kluwers’ recent look into Generative AI in Healthcare and the need to gain consumer trust.

There are other aspects of consumer-facing health care I’m working on in 2024 – namely, digital health technology moving care into peoples’ homes and closer-to-home – and I’ll be writing more about that next week in my lead-up to attending CES 2024 in Las Vegas in early January….so please stay tuned for more on consumer health tech trends and the growing retail health ecosystem.

Wishing you all great joy, health, and peace….JSK