Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans.

That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance.

The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study (quantitative and qualitative) and analyze the results.

I live and breathe and work with patient and consumer health financial data every working day. I’ve absorbed a lot of graphic and data visualizations, read countless peer-reviewed papers, and reviewed myriad PowerPoint decks.

While the findings of the research are not new-news, per se, they are presented in a chillingly compelling format that might touch your head and heart in new ways as they did mine. I have no skin in this game except to review ongoing research, feed it into my own learnings, and share them out in my work and communication.

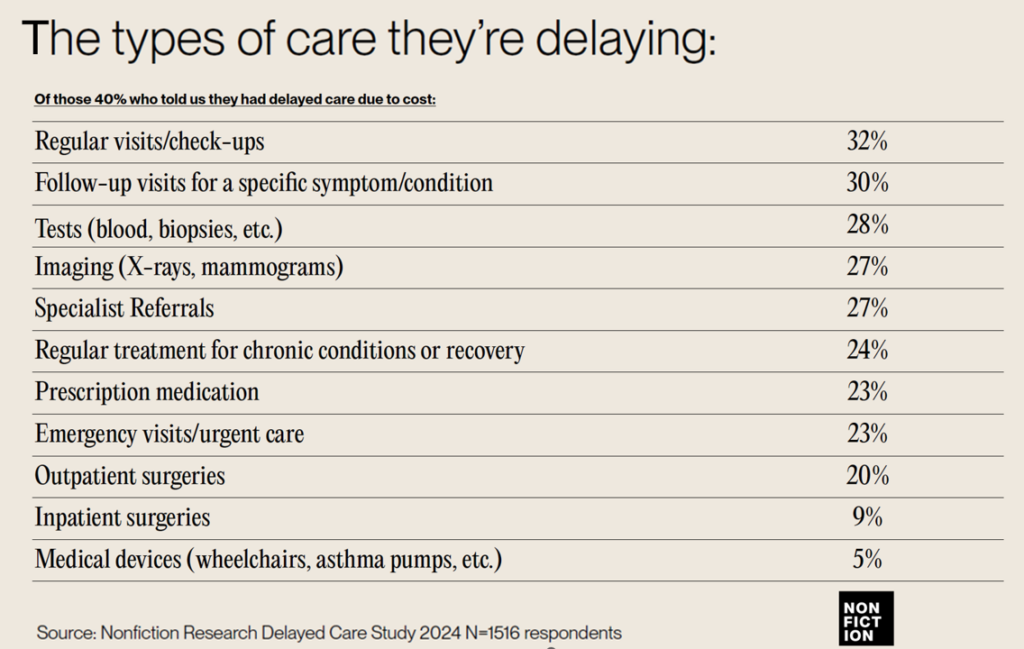

In this poll, 2 in 5 U.S. health insured workers had delayed some aspect of health care due to cost: these services were most likely regular visits and check-ups (about one-third of the self-rationing insured population), follow-up visits for conditions (another one-third), lab tests, imaging, specialist referrals, prescription meds, and urgent or emergency visits for another roughly 1 in 4 insured people. One in 5 people also postponed outpatient surgery.

Health Populi’s Hot Points: How do these delays in care make people feel, both physically and emotionally? First, the diminished or exacerbated clinical outcomes that people face — downward spirals of chronic conditions, worse acute diagnoses (say, advanced cancers), and pain.

Then, there are the fiscal-economic hits to bank accounts, mounting debt, and financial stress faced by patients who cannot make a relatively small contribution toward a high deductible or co-insurance share for a specialty drug (which may be much higher than that deductible amount depending on how “special” [um, expensive] that medication is — highly dependent on the access program that may or may not be available to the patient).

Among these quotes, let’s pull out 2 that demonstrative the physical lens and one the pain-stress lens….they communicate so much about patients’ Hidden Lives:

“Last year I cut my arthritis medication in half and only took half a dose every day because I was trying to save enough for the end of the year….But when I went to the doctor, he told me it’s a time release med, so if I cut it in half it doesn’t work.” Here the value of the drug was in the time-release and the patient’s lack of knowing that — trying to be fiscally responsible by pill-splitting, compromising his physical well-being — was a huge risk.

Then this…

“I was very frustrated, very moody because the pain was so bad. I would try to bear the pain. But when I was at work I would go to the bathroom, and crunch over, and silently scream,”

confessed a 40-year old administrative assistant in their interview with Nonfiction.

Hats off and bravo to the Nonfiction team who brought new insights and perspectives into the uniquely American situation of financial toxicity in health care. And to Paytient for sponsoring this important research and sharing the impactful findings with us.