MicroStrategy made its second multimillion-dollar purchase of bitcoin in a little more than a week, raising the company’s holdings to more than 1% of all the cryptocurrency that will ever be issued.

The enterprise software maker, whose corporate strategy includes buying the digital currency, purchased 9 245 bitcoin for US$623-million between 11 and 18 March, according to a US Securities and Exchange Commission filing on Tuesday. The purchase, along with a $821.7-million bitcoin acquisition announced last week, were both financed mostly through the sale of convertible notes.

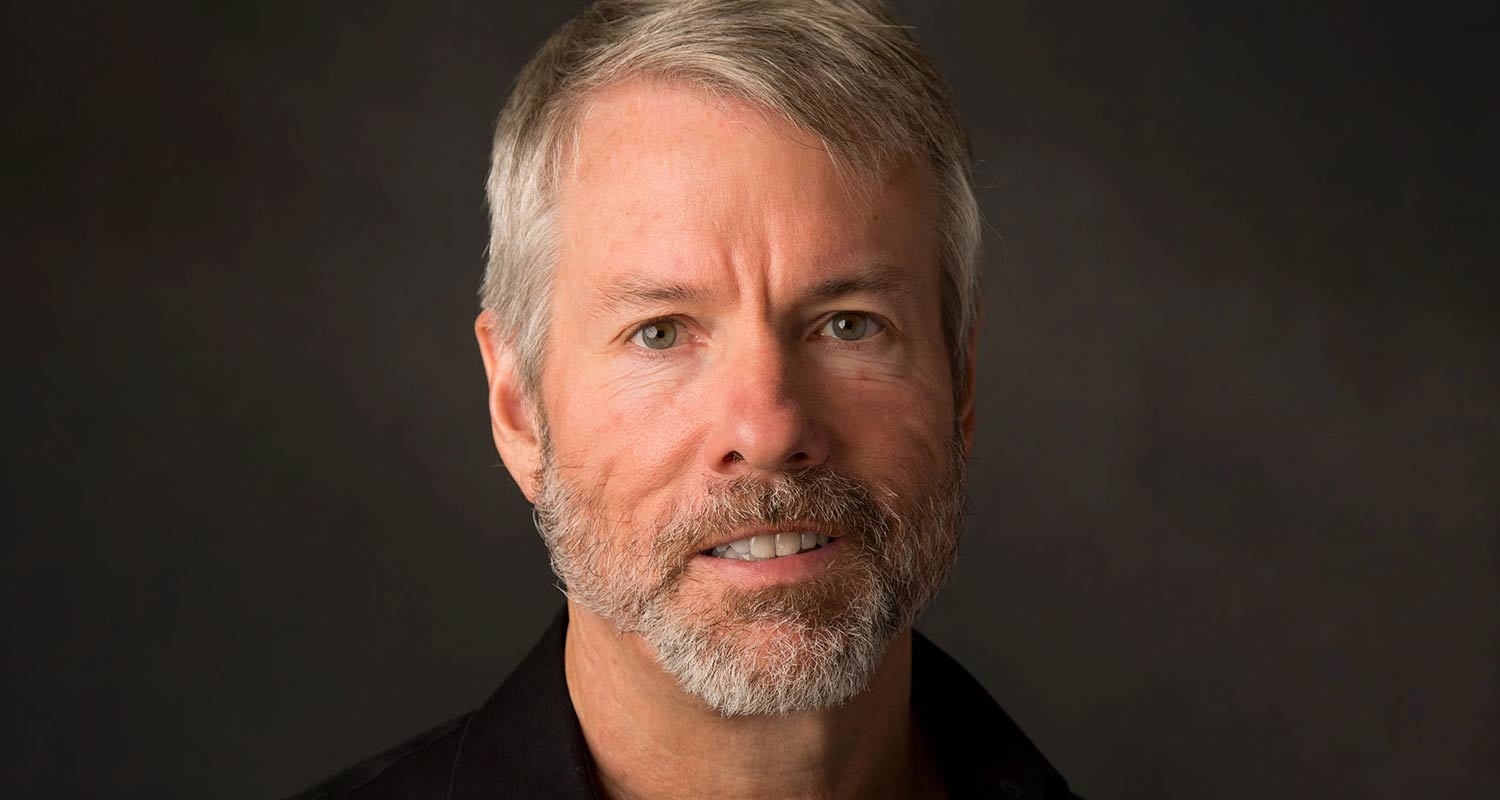

Michael Saylor, the chairman and co-founder of MicroStrategy, started buying bitcoin in 2020 as an inflation hedge and alternative to holding cash. The company holds 214 246 tokens valued at around $14-billion. The maximum total amount of bitcoin is 21 million, with about 19.7 million tokens having been issued so far. It is estimated that the milestone will be reached in 2140.

In terms of money spent, nearly a quarter of MicroStrategy’s bitcoin purchases have happened in 2024 and at an average cost that is more than twice last year’s average cost.

The average price for the latest acquisition of bitcoin was $67 382, while the average price for MicroStrategy’s total holding is $35 160, according to the filing. Bitcoin fell about 5.7% to $63 500 on Tuesday.

The Tysons Corner, Virginia-based firm completed the sale of $603.8-million of convertible senior notes through a private sale on 18 March.

MicroStrategy isn’t the only company taking advantage of surging share prices and demand for bitcoin to raise debt. Coinbase Global, the largest US crypto exchange, said on Monday that it raised the sale of its own convertible note issue to $1.26-billion. — Muyao Shen, with Tom Contiliano, (c) 2024 Bloomberg LP