From Evolution to Innovation, from Health Care to Health: How Health Plans With Collaborators Are Re-Defining the Industry

As a constant observer and advisor across the health/care ecosystem, for me the concept of a “health plan” in the U.S. is getting fuzzier by the day. Furthermore, health plan members now see themselves as medical bill payers, seeking value and consumer-level services for their health insurance premium investment.

Weaving these ideas together is my mission in preparing a session to deliver at the upcoming AHIP 2024 conference in June, I’m thinking a lot about the evolving nature of health insurance, plans, and the organizations that provide them. To help me define first principles, I turned to the American father of the dictionary, Noah Webster.

Then I asked ChatGPT for a response.

Consulting Noah Webster….and ChatGPT. According to the online Merriam-Webster dictionary, the first use of the phrase “health insurance” occurred in 1901. Its meaning was, “insurance against loss through illness of the insured,” especially, “insurance providing compensation for medical expenses.”

English language scholars have noted a key aspect of Webster’s importance was his keenness to innovate when he thought innovation meant improvement. Webster was the first to note that Americans spoke a unique kind of English and worked to streamline it. (He was also one of the nation’s first epidemiologists, a topic for another time – but if you’re keen to explore, you can check out his gargantuan two-volume History of Epidemics and Pestilential Diseases published in 1799).

Turning to ChatGPT some 123 years later, I queried, “What is a health plan?”

The response:

A health plan is a comprehensive package of healthcare services and coverage that helps individuals or groups manage and finance their healthcare needs. Health plans are designed to provide a range of medical services, preventive care, and financial protection against the costs of healthcare. These plans can vary widely in terms of coverage, cost, and provider networks.

Neither of these explanations satisfies my current view of where I see the industry at this moment, and especially as I work through my forecast to 2030.

Like speaking “American,” health insurance in the U.S. has evolved in a unique way, as health insurers continue to re-define just what a “health plan” is.

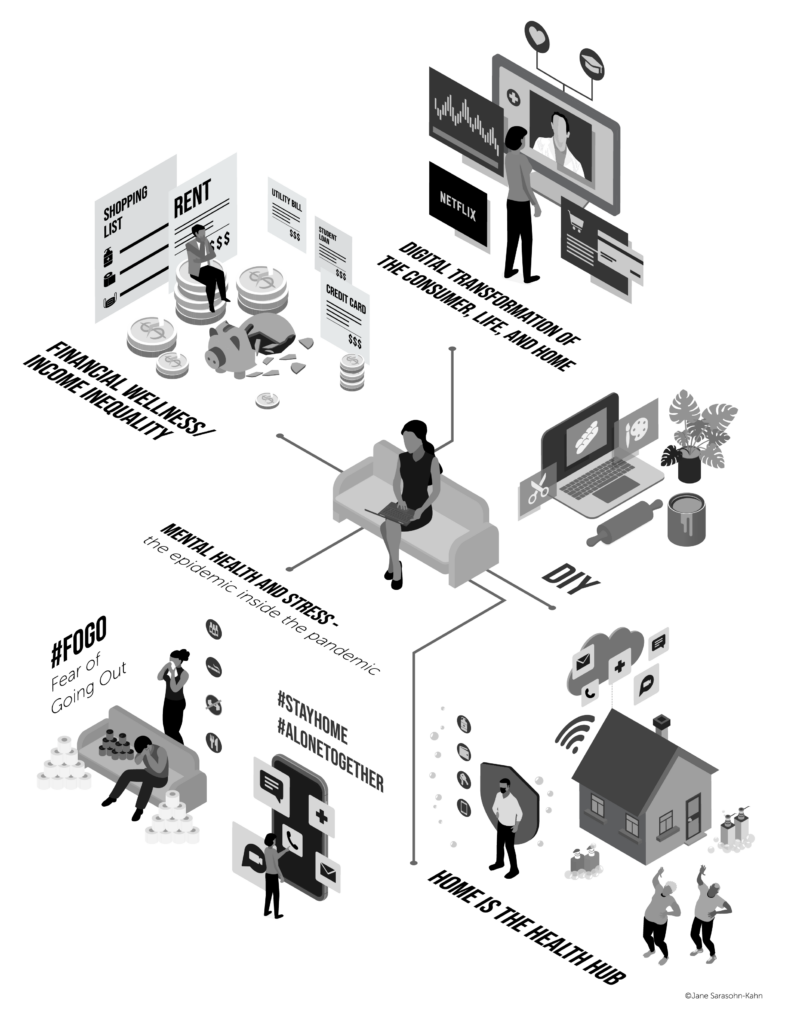

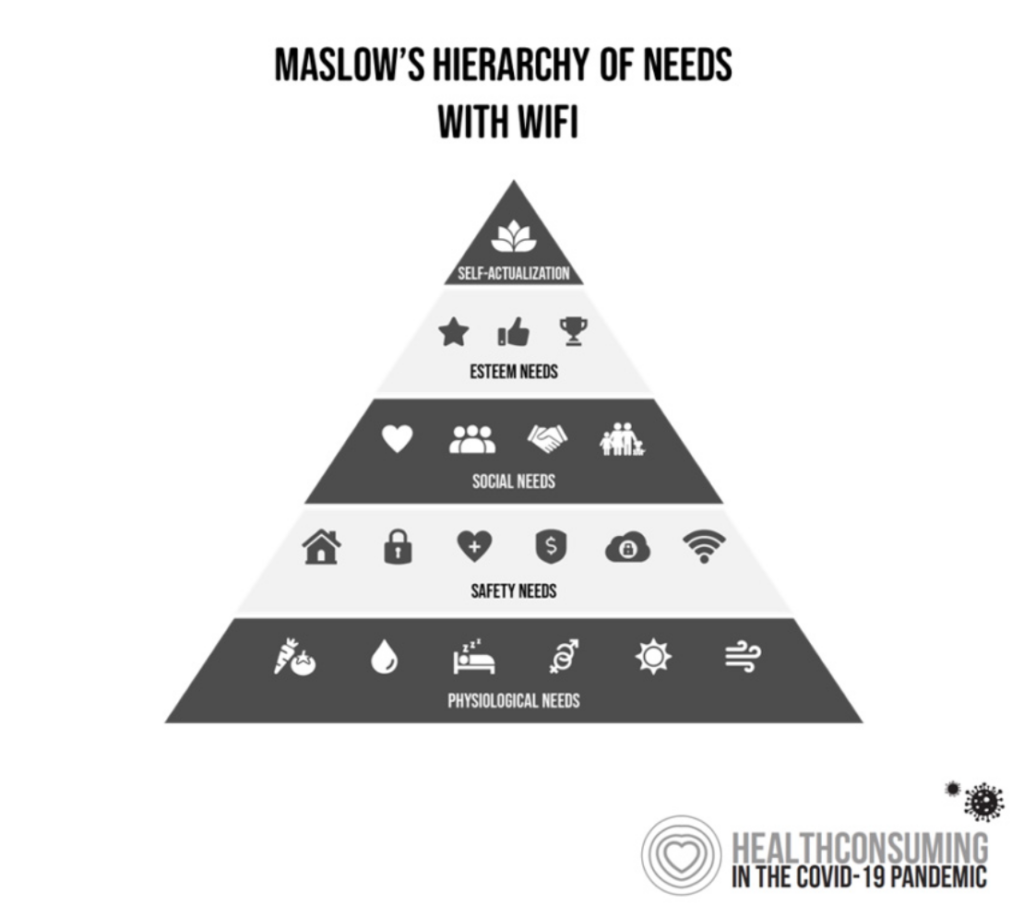

Patients and health plan members continue evolving into medical bill payers, with their homes and budgets baked into the concept. These trends began to take hold in the U.S. in 2018 and 2019, with the pandemic and public health emergency accelerating the concept of the home as the health hub,

The health care system, including the insurance sector, is dealing with several pragmatic realities that are informing strategies for innovation and collaboration: first and foremost, the reality that the health of patients is worse than peoples’ health status pre-pandemic, according to a Sage Growth Partners report published in January 2024. This challenge has been exacerbated by many patients postponing care resulting in missed preventive screenings and delaying needed chronic care – which Teladoc has described as a growing “health debt” resulting from pandemic-related changes in health behaviors.

At the same time, health system leaders in the study cite three key strategies topping their list, including the need to grow revenue, recruit and retain staff (think: burnout), and reduce costs.

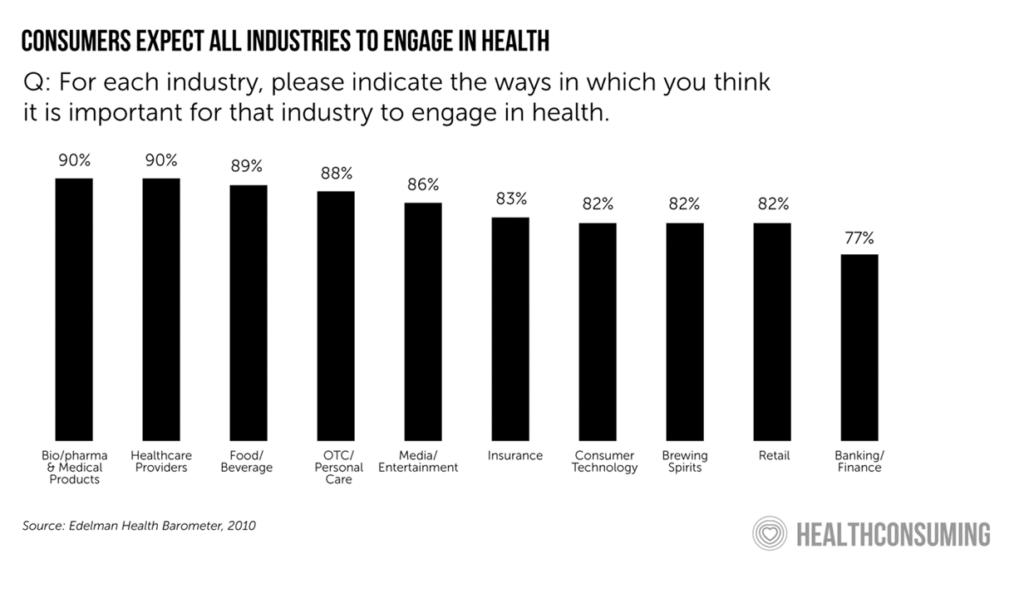

Keeping those criticalities in mind, we see health plans and other stakeholders in health developing and implementing strategies to address citizen health (holistic, mind-body-and=spirit) while assuring companies’ financial viability.

Consider the following market developments and collaborations that are addressing health access, bolstering value-based models, streamlining and re-imagining service delivery.

Expanding value-based care, nationally. The combination of Kaiser Permanente and Geisinger to form Risant Health will be a test of how Kaiser can build a national brand while embedding its approach to a regional health system that has been geographically boxed-in in central Pennsylvania. Geisinger plans to open more clinics for primary care, senior care, and convenient/retail care. In the meantime, Risant plans to scale the model into other health systems for a national footprint.

Re-building a community health system from an innovative blueprint. The investor General Catalyst has partnered with over 20 health systems in the past few years, learning along the way. In October 2023 the company created the Health Assurance Transformation Company (HATco) to collaborate with health systems in re-imagining and implementing a blueprint for “interoperable” health care. To start, HATco will acquire the Summa Health system in Ohio to build out that blueprint for the benefit of all health citizens in the community. Of particular note is the organization’s “promise of health assurance – care that is more proactive, accessible, and affordable to people everywhere.”

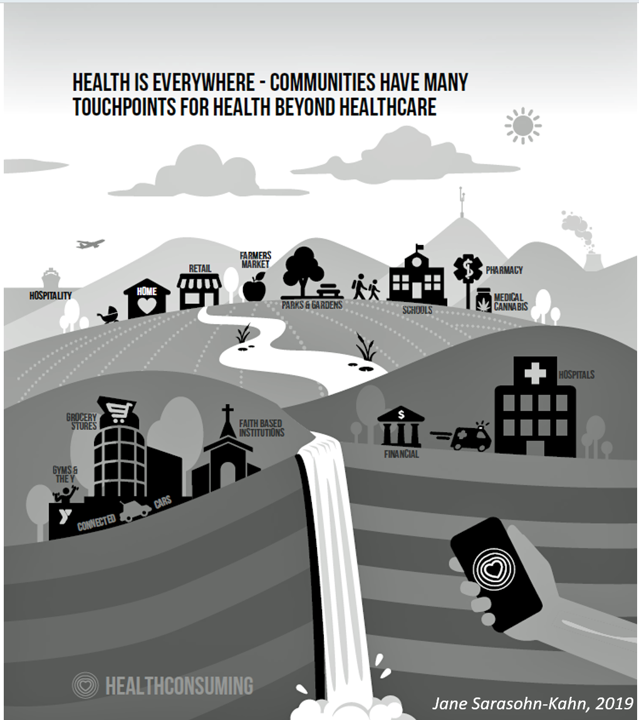

Retail health-meets-Medicare. Walmart launched a ten-year collaboration with Optum in late 2022. This work started in 2023 involving Walmart Health clinics serving Medicare members and looking to partner with UnitedHealth plan members and others. Over the decade, plans could also involve Walmart’s offerings from the grocery store to the pharmacy, vision and dental services, and health and beauty aisles. Furthermore, Walmart continues to grow its presence in health care partnering with health systems, such as Orlando Health and Ambetter from Sunshine Health in Florida. Such collaboration expands Walmart’s hand in building out omnichannel health care in patients’ communities, closer to home as well as online.

The grocery store as health assurance partner. Through the pandemic, grocery stores strengthened their role as health destinations – especially those with co-located pharmacies. Grocery chains continue to grow the role they play in their communities for families seeking not only food-for-health and well-being, but for health care services such as immunizations and dieticians’ advice along with access to health insurance. Kroger Health (part of the Kroger food chain) has several partnerships with Medicare Advantage plans, including Select Health (part of Intermountain Health) and Priority Health in Michigan, and began to work with Anthem (now Elevance) in 2021. Kroger Health is also working with Soda Health to improve health plan member’s food security.

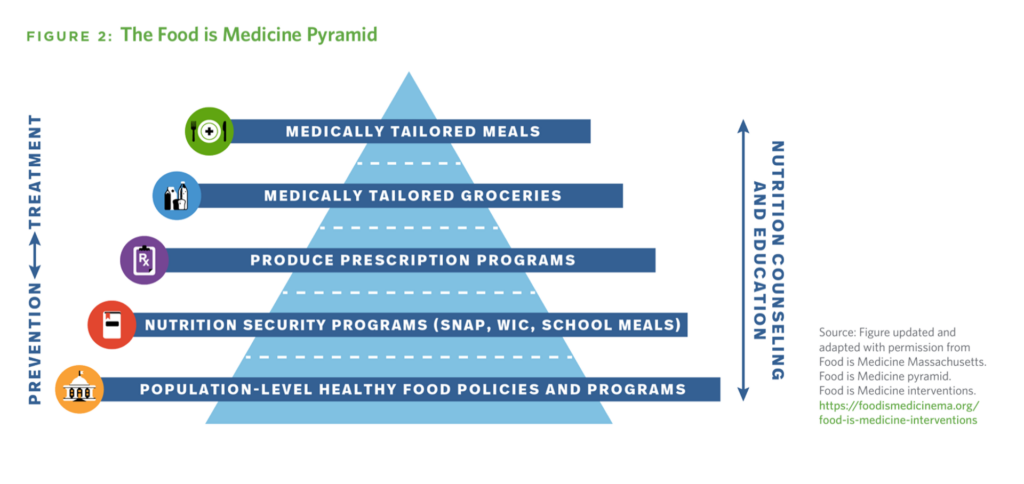

How Instacart and Mom’s Meals are addressing food-as-medicine. The social determinant of health risk of food insecurity has gained credibility in the U.S. among providers and payors. Instacart, the grocery delivery company, is a fast-emerging stakeholder addressing food security through its operation, Instacart Health. With the tagline “delivering the ingredients for healthier living,” IC Health began working with Dispatch Health in early 2024 to enable Dispatch’s home health workers to prescribe food interventions for patient clients: these are in the form of digital food stipends that go into IC’s Fresh Funds as well as offering medically-tailored shopping lists and delivering the food to patients’ homes. Instacart Health also expanded SNAP benefit recipients to shop online for groceries from over 14,000 stores under 170 retail banners, reaching 96% of SNAP households in the U.S. Mom’s Meals, a provider of medically-tailored meals working with health plans and providers, shared results of a program run by Inland Empire Health Plan (IEHP) providing medically-tailored meals to dually eligible (Medicare + Medicaid) members in California. The program resulted in a reduction of both trips to the emergency department and hospitalizations among patients dealing with congestive heart failure.

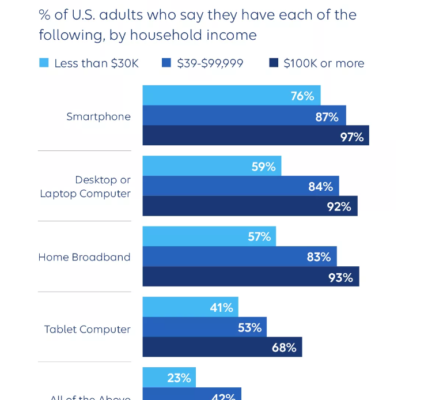

Connectivity as a social determinant of health. As the pandemic revealed the risk of food security in U.S. households, so too did the public health crisis shine a light on some peoples’ lack of connectivity to the Internet – which is now broadly accepted to be a key aspect for living, working, getting educated, social health, and connecting for care. At CES 2024, Elevance Health’s CEO Gail Boudreaux discussed the health plan’s partnering with the major telecomms vendors to essentially “prescribe” mobile phones for health. She described the company’s “whole-health approach….about simplifying healthcare and building trust with customers. Digitally enabled healthcare means building digital technologies into the fabric of our ecosystem to improve outcomes and enhance efficiency in day-to-day health and wellness.”

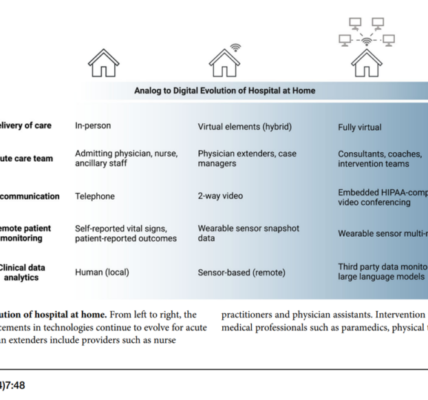

The home as a site for health care. In the continued shift of medical care delivered in the comfort and convenience of peoples’ homes, Best Buy Health is scaling Geek Squad-meets-consumer-technology expertise to health, collaborating with health systems to support this effort. The retailer has relationships struck with Atrium Health/Advocate, Geisinger, Mount Sinai, NYU Langone Health, and Parkland Health System, along with the UK National Health Service (NHS).

Virtual first and direct primary care for faster on-ramps to care. One of the obstacles facing some U.S. patients still delaying care is lack of easy access to primary care, especially risky for patients dealing with chronic conditions. Recent research from a team at Harvard Medical School made the case for virtual-first, outcomes-based primary care that enabled the care team to build engaged and trusting relationships with patients and families – “reconnecting team members with joy in clinical practice,” as the researchers noted. In non-value-based payment environments, this would require changing payment regimes along with assuring broadband coverage for telehealth connectivity for patients who might lack that crucial connectivity. Omada Health has proven out a model for virtual-first care, recently announcing an alliance with Amazon Health Services’ Health Condition Programs that help consumers discover programs available to them through their health plan or employer. Employers have become keen on leveraging telehealth as part of a holistic benefits approach, Teladoc found in their 2023 Virtual Care Transformation Index.

Collaboration can help insure as well as assure health. The examples of collaborations and alliances described here have been just a toe in much deeper water that’s the evolving health/care ecosystem. I’m looking forward to partnering with AHIP ahead of AHIP 2024 and learning from more case studies and best practices that will be shared during the conference in Las Vegas in June.

I’ve long advocated for collaborations like these, across industry siloes and cross-sector, which inspire creativity, innovation, and community.

To inspire us in community and collaborative spirit, let’s turn back to Noah Webster who wrote in his 1798 treatise on epidemics,

“I am persuaded the world, without frequent inflictions of pain and distress, would not be habitable. The natural evils that surround us, intermingled

with innumerable blessings, preserve the mind in perpetual vigor…they lay the foundation for the exercise of the finest feelings of the human heart, compassion and benevolence, which are the sources of social virtue…”

Webster seems to have laid the foundation aligned with General Catalyst’s Health Assurance principles which favor,

“Partnerships over pure disruption, and empowering consumers with technology and experiences that both inform and delight, while honoring privacy and protecting data. These companies have critical work ahead…[to] improve clinical outcomes; alleviating the burdensome administrative and technological roadblocks that prevent doctors and nurses from doing what they do best; and aligning performance and the interests of patients, providers, and greater society.”